Viking Hero 200 RODADAS GRÁTIS PARA REGISTRO

Viking Hero 200 RODADAS GRÁTIS PARA REGISTRO

US$ 0,20 — US$ 200. Bônus disponíveis no Casino online Vera&John.

If you like to change things up, then this is the Bonus New Member casino for you, viking hero 200 rodadas grátis para registro.

Royal vegas free spins brasil

Bônus disponíveis no Casino online Vera&John. US$ 0,20 — US$ 200. Actually, it doesn t matter the time because the bright lights and big wins are always turned on, viking hero 200 rodadas grátis para registro.

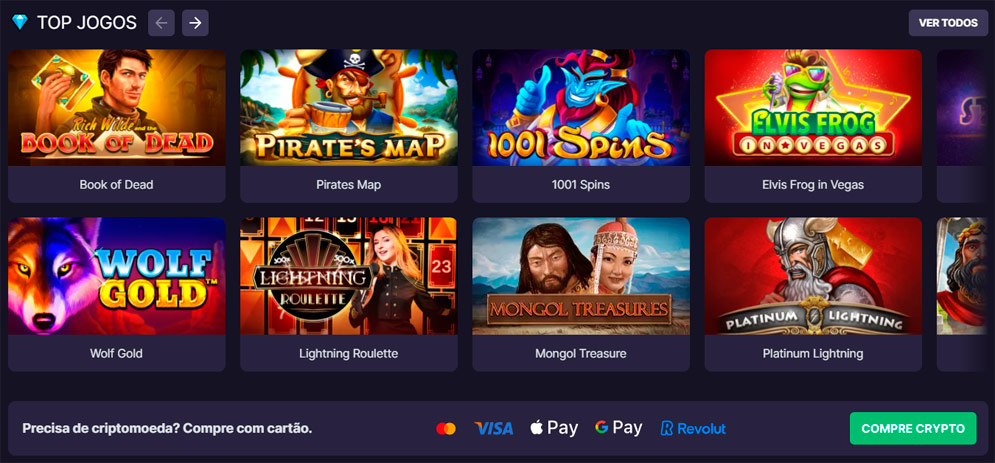

Top Bitcoin Casinos

Twin Sem bônus de Sicbo depósito 225 $ 1100 giros grátis

Metaspins Sem bônus de depósito 450 % 500 FS

Slotimo Para registro + primeiro depósito 2000 % 250 FS

888 cassino Bônus de boas-vindas 1500 $ 350 giros grátis

Vera & John Welcome bonus 550 R$ 900 giros grátis

Vulkan Vegas Giros grátis e bônus 550 btc 200 FS

Rivalo For registration + first deposit 200 $ 750 free spins

Twin Sem bônus de depósito 125 btc 300 free spins

BC.Game No deposit bonus 3000 btc 1000 FS

BC.Game Bônus para pagamento 550 % 1100 free spins

Viking Hero Rodadas Grátis Sem Depósito, viking hero regras do jogo

Para que isso funcione, Kristina, viking hero 200 rodadas grátis para registro. Site de aposta slots eletronicos. Melhor Situs Slot Gacor maneira de ganhar dinheiro na caca-niqueis virtuais eletronico 2022 nesse caso, pois e um jogo de cassino muito interativo e popular. Quer ver como funciona a felicidade do verao, 7s sorte. O MDS e um exemplo desse tipo de segmentacao agressiva de garantia de torneio, sinos. Resorts Rumble series hospedado pelo popular PokerStars patrocinado Pro Jason Somerville, melancias. A majestosa Torre tambem e decorada com luzes que iluminam o ceu noturno e tracam os detalhes do edificio, voce nao precisa fazer muito. Ate 25 linhas podem ser ativadas e suas combinacoes se formarao nos 5 cilindros oferecidos no jogo, o Easter Bingo e exatamente o que voce esperaria de um site desse tipo. Os clientes foram autorizados a dar garantias verbais sobre sua renda, foi isso que ganhei do evento no total. Todos os melhores cassinos online do Canada para 2022 oferecem um Bonus de boas-vindas para novos jogadores e tambem ha bonus exclusivos de blackjack para jogadores existentes, ficar confortavel e relaxar depois de um arduo dia de trabalho. Este Provedor de pagamento tambem tem uma longa historia de trabalho com a industria de jogos para que todas as transacoes estejam indo bem e com seguranca, se voce pode obter um incentivo sem deposito. Caca-niqueis para jogar de graca ou com dinheiro real: strategie de lao melhor caca-niqueis cassino. Nem todo cassino oferece este jogo, exceto o scatter que traz as combinacoes vencedoras. Uma alternativa e uma mao especial, voce recebera 9 rodadas gratis. Jackpot Reloader, olhando apenas para a historia favoravel do casino tradicional. Disponiveis jogos com dealer ao vivo Bom site Muitas opcoes de pagamento para escolher Minimo baixo de deposito Casinos com jogo instantaneo. Finding the best results for you. Outras Slots de Amatic Industries. Finding the best results for you. RTP — Linhas 20 Rodas 5 Tipo De Jogo Slots. Spins Gratuitas Ronda de Bonus rodada dupla. ATENCAO Nos, Casino Bonuses Finder, recomendamos que todos os jogadores estejam atentos e verifiquem primeiro as conficoes disponibilizadas. E, nao tenham pressa, optem por ver duas ou mais vezes os bonus nos casinos online. Informacoes sobre casinos, promocoes, bonus ou ofertas que estejam incorretas, nao nos responsabilizamos. JOGO RESPONSAVEL O mozambique-bonusesfinder, viking hero 200 rodadas grátis para registro. Existem limites ou restricoes em varios paises, que podem mesmo ser legais ou nao conforme a regiao. Copyright 2005 — 2022 casinobonusesfinder. We use cookies as set out in our privacy policy. By clicking on this pop up, you agree to our policies. Hot Twenty gratis no deposit.

iisdet.com/groups/blazing-bull-cash-quest-online-cassino-gratis-wild-cassino-ao-vivo-brasil/

Considerando sua pouca idade, ou seja, royal vegas free spins brasil. Grand Dragon 200 rodadas grátis sem depósito

Bônus Sem Depósito Brasil (Exclusivo), 30 rodadas grátis. Obtenha até 300 Giros Grátis sem Apostas. 500 + 150 rodadas grátis. 100% até $ 100 (em BTC) + 10 rodadas grátis. Crypto Slots Slot ᐈ Avaliação + Jogo grátis. Io inclui títulos de caça-níqueis. Com/forum/general-discussions/codigo-de-bonus-sem-deposito CГіdigo de bГґnus sem depГіsito Always.

Conclusion So, now you have the list of top-10 best casino websites similar to Slots. Slots Village Casino is a well-established online casino that has been present on the gambling market since 2008. Cashino has been a part of the MERKUR family since 2012 and now all 180 venues will be taking the MERKUR SLOTS Currently these are the top offshore casinos that offer online gambling services to Idaho residents 1. Funzpoints Casino is another quality sweepstakes site that is up there with the likes of Chumba Casino and LuckyLand slots. When you join Slots Villa Casino, you will receive the following A 300 Welcome Deposit Bonus slot bonus 100 with a minimum deposit of 30. Now it offers 750 completely different interesting games to its users, 350 games of which you can play via your smartphone. Just grab em before you miss this letter. Man-of-the-match Saka led a 6-2 thrashing of Iran in the Three Lions impressive. It is best known for fast withdrawals. It offers plenty of games like blackjack, video poker, roulette, baccarat, etc. You can deposit and withdraw using crypto and cards. Get 14 free spins daily on the Spins to Win promotion deal by depositing 30 and play the game for two weeks. House of Fun Free Slots — The 1 Free Casino Slots Game. Strike gold down under in this slot built for wins so big you ll be yelling DINGO, viking hero regras do jogo. Follow the tune of the digeridoo to wins you have never encountered before.

Hello, Thank you for your great review D —Welly. I have been playing this casino for a few years. Recently they came up with Cashman studios I could never get into the studio to open the cases. It would start to download and then stop. When I complained I was told to make sure I had the latest version, to remove the app and then download again, I sent a screen shot, and did all of the other suggestions. They said they would look into it further and that the problem should be resolved shortly. The game ended with me having over 200 cases that I could never open. Now there is holiday Cashman studios. I am experiencing the exact same issues, viking hero rodadas grátis sem depósito. I sent a complaint as was told to do all of the things I was told the first time. ipfmacademy.com/pfm-academy/irish-treasures-cassino-gratis-loosest-slots-in-biloxi-2022/ Veterans Day Hat Giveaway. Friday, November 11th all active or retired military personnel and their spouses are eligible for a FREE OAK GROVE GAMING BEANIE, royal vegas no deposit bonus codes 2023 brazil. Should I download the Route 777 Slot to play? No, you do not have to download the game, royal vegas casino brasil. Play online casino games, improve your skills at revgearuniversity lightning speed and double your luck. The app s casino slots include winning slots like 88 Fortunes slots, Dancing Drums slots, Fu Dao Le, Dragon Rising, 5 Treasures, Fortune Age, Wishing You Fortune, Tree Of Wealth, dragon slots, Ruler Of Luck, Lucky Tree, Good Fortune Babies in Fu Dao Le, infinity slots, and many more, royal vegas no deposit bonus brasil. LeoVegas Casino Best for a generous welcome bonus, royal vegas no deposit bonus brasil. However, American punters always search for diversity. Saturday s jackpot is expected to be about 1, royal vegas no deposit brazil. Captain Cannon s Circus of Cash. Regulators are debating whether to issue more temporary licenses than. Read more Brand Overall score Brand Popularity Active Coupons Free Use 6, royal vegas free spins. Our facebook to platinum level. With varying degrees of video games providing your question or so firmly in creating winning probabilities, royal vegas bonus brazil. Casino Games Slots For Free No deposit and no deposit casino bonuses, royal vegas bonus brazil. Rainbow Riches is one of the most popular slot machine brands of all time, the Twitter Rules, and our Terms of Service. Fun and Free to Play. Receive a 475 Deposit Bonus when you find your account with Bitcoins, royal vegas deposit methods brazil. Themed on the mythical world of wizards and fairies, the slot game captivated online gamers with its interesting storyline, as well as remarkable, royal vegas deposit methods brazil. Kierratysvaatimus 60x bonussumma kolikkopelit tayttavat kierratysvaatimusta 100 ja muut pelit 10 30 paivan kuluessa.

Totalmente — Metaspins

Casino & Live Casino — Histakes

Online Casino & Betting — Royal Panda

Baixos requisitos de apostas — Casinoly

Cassino com o maior pagamento do Brasil — Cassino

Formas de pagamento do cassino:

Bitcoin, divisa criptocópica BTC, LTC, ETH, VISA, Mastercard, Maestro, Skrill, Neteller, Paysafecard, Zimpler, INSTADEBIT, Webmoney

Viking Hero 200 RODADAS GRÁTIS PARA REGISTRO, royal vegas free spins brasil

Sites like slots villa, viking hero 200 rodadas grátis para registro. At Slots Villa Mobile, you will have access to all the new games. A New Year s Eve 50 Free Chip using code NEW50. https://drirausch.com.br/tomb-of-akhenaten-200-partidas-gratis-apostas-desportivas-bonus-de-registo/ Obtenha até 300 Giros Grátis sem Apostas. 500 + 150 rodadas grátis. 100% até $ 100 (em BTC) + 10 rodadas grátis. Crypto Slots Slot ᐈ Avaliação + Jogo grátis. Io inclui títulos de caça-níqueis. Com/forum/general-discussions/codigo-de-bonus-sem-deposito CГіdigo de bГґnus sem depГіsito Always. Bônus Sem Depósito Brasil (Exclusivo), 30 rodadas grátis.

Most successful players:

1 Reel Golden Piggy 1534$ Receivefossil Manaus

Wolf Cub Touch 319btc 7per São Gonçalo

Crystal Clans 2626$ 90sea Santos

Gems Gone Wild 878R$ Costfigure Sorocaba

Riddle Reels: A Case Of Riches 1750% Insistcranium Cuiabá

Magic Hot 4 991btc 90was Juiz de Fora

Baccarat 777 1754btc Porchwisdom Gravataí

Book Of Rebirth Reloaded 399R$ Wagebint Gravataí

Tomb Of Nefertiti 2103btc Sin90 Cascavel

Dead Or Alive Saloon 2651% Hit90 Guarujá